To view the full Industry Indicators report and the Pulse Survey, log in to your member account.

BEMA Intel

KEY TAKEAWAYS

BEMA Intel Industry Indicators

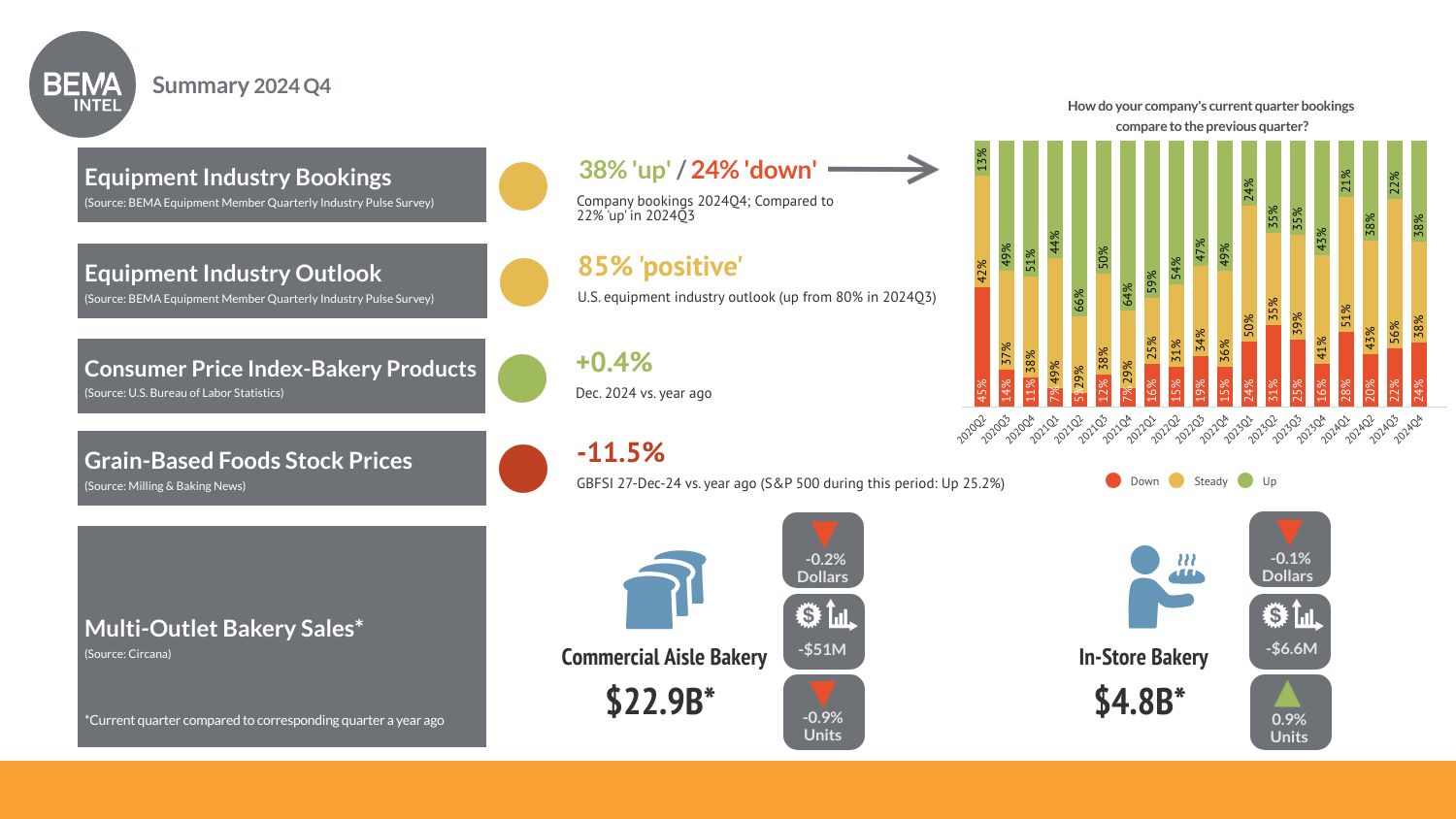

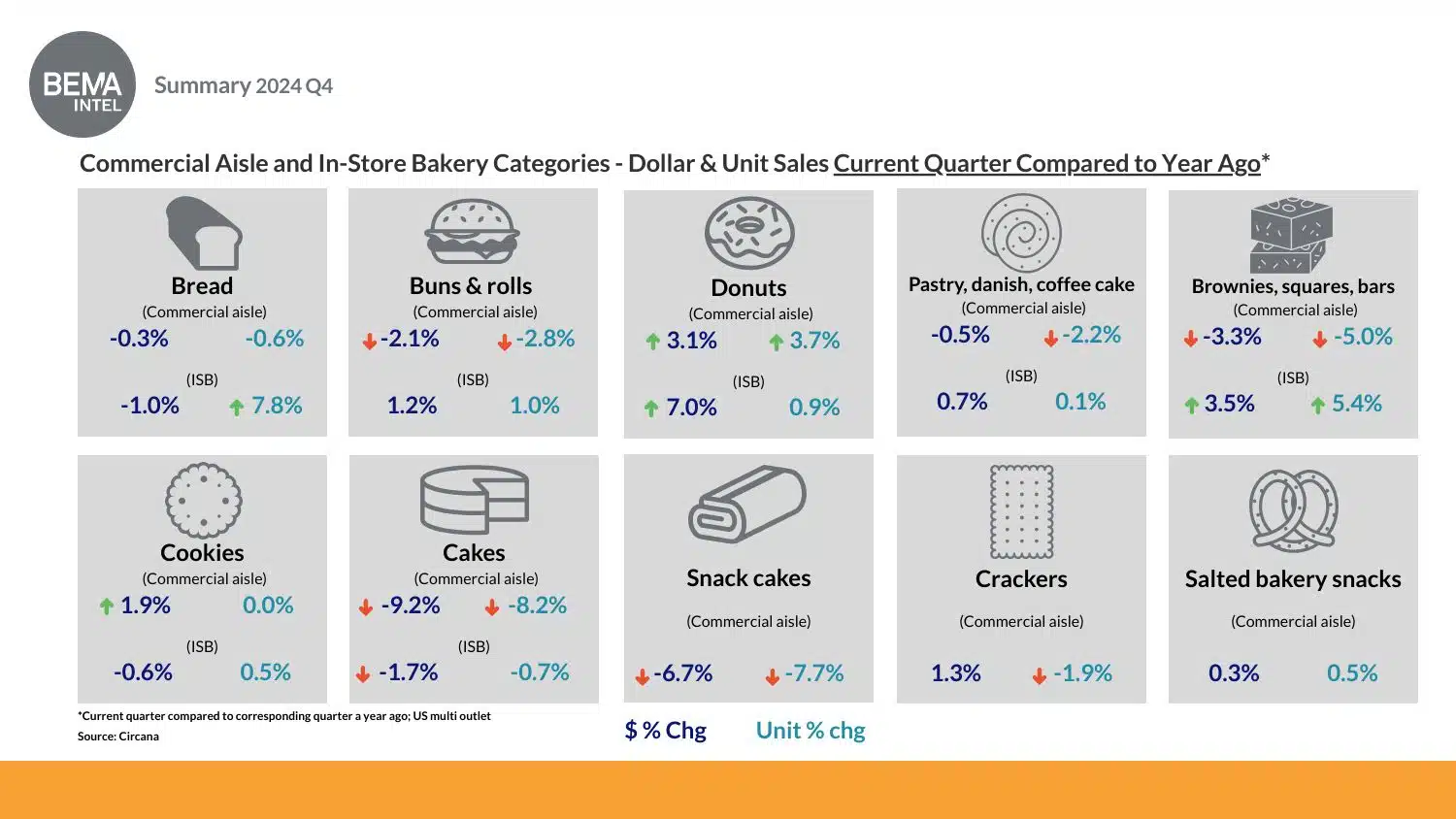

- In the fourth quarter of 2024, Commercial Aisle Bakery dollar sales for the quarter totaled $22.9 billion, a slight decrease of 0.2% compared to the corresponding quarter in 2023. Unit sales were also down slightly 0.9% for the same period, continuing to suggest that increased prices due to high inflation have impacted consumer demand in the category.

- In the fourth quarter of 2024, In-Store Bakery dollar sales were down slightly 0.1% to $4.8 billion compared to the corresponding quarter a year ago, with unit sales up 0.9%.

- Importantly, the Grain-Based Foods Stock Index was down 11.5% in the fourth quarter of 2024, while the S&P 500 increased 25.2%.

- The Consumer Price Index for Bakery Products increased only slightly at 0.4% in December 2024 compared to the previous year, following major increases in the CPI that began during the inflationary period in 2022.

- Baking ingredient costs for some categories tracked by Milling & Baking News’ Bakery Ingredient Indexes continue to decline or level-out. Ingredient costs for white pan bread continued to decrease 15.9% in 2024Q3 compared to a year ago. The index for devils food cake, however, was up 35.4% in 2024Q4 compared to a year ago due to high cocoa prices.

- Unemployment increased to 4.0% in December 2024. Unit labor costs are leveling out somewhat, with an increase of 2.5% for 2024Q4 compared to the same quarter a year ago.

- Flour production was up slightly 1.9% in 2024Q4 compared to a year ago.

BEMA Intel Member Pulse Survey

- Equipment manufacturer industry outlook increased slightly in 2024Q4, with 85% expressing a ‘positive’ outlook, compared to 80% in 2024Q3.

- In the area of company bookings, 38% of equipment manufacturers reported increased bookings in 2024Q4, up from 22% in 2024Q3. Twenty-four percent of equipment manufacturers reported decreased bookings in 2024Q4, up slightly from 22% in the second quarter of 2024.

- Trade uncertainties rose to the top of the list of challenges for equipment manufacturers, with 49% citing it as a challenge in 2024Q4, up from 33% in Q3, and 23% in Q2.

- Attracting and retaining a quality workforce is the next biggest concern, with 37% citing it as a challenge in 2024Q4, down slightly from 44% in Q3.

- Concerns over raw material costs have decreased significantly, with 28% of equipment manufacturers reporting concerns in 2024Q4, down from a high of 91% in 2022Q2.

Summary 2024 Q4

What is BEMA INTEL?

The BEMA Intel Industry Summary report presents at-a-glance topline trends for key U.S. economic and commercial baking industry indicators. Updated quarterly, this overview provides a high-level view of the state of commercial baking and equipment manufacturing industries to aid in planning and critical decision making.

BEMA Intel Industry Indicators

This report contains detailed, historical. and current trending data for key industry indicators most helpful in understanding the changing health of the U.S. commercial baking and equipment manufacturing industries, as provided by data from Circana, Milling and Baking News, USDA and more. The complete report is only available to BEMA members.

BEMA Intel Member Pulse Survey

A confidential online survey among BEMA equipment manufacturing members reflecting global and U.S. industry outlooks, company outlook by product channel and bookings/sales, and top business challenges. The full results of this survey are only available to BEMA members.